I. Introduction: Why Second Hand Branded Shoes Wholesale Has Become a High-Profit Track

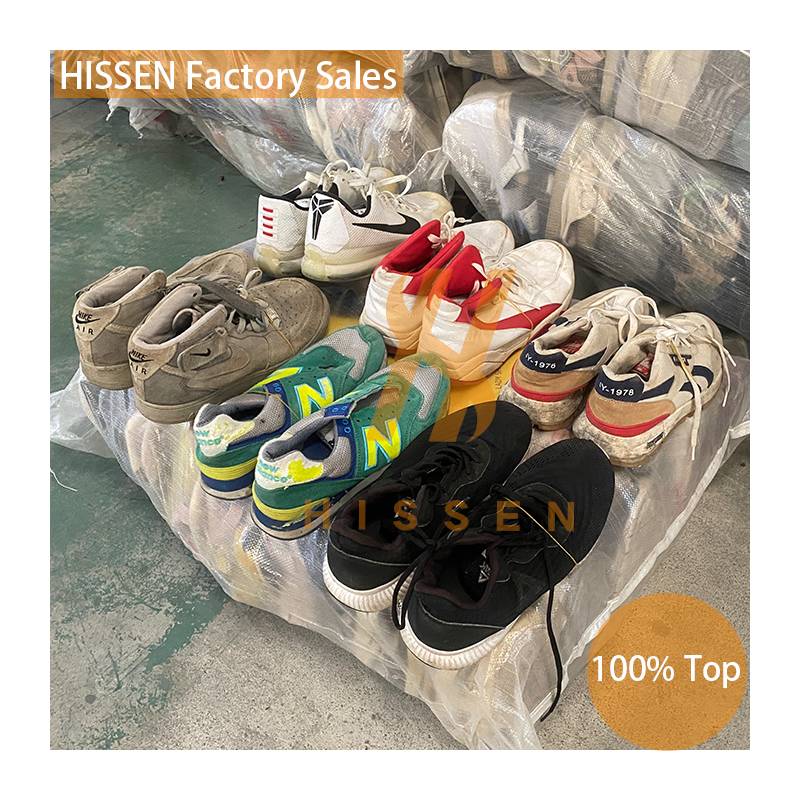

In today’s global footwear industry, the wholesale market for second hand branded shoes is gaining significant momentum among B2B buyers. Distributors, resellers, and trading companies are discovering that branded shoes—once owned but still in excellent condition—offer not only attractive margins but also strong market demand. Unlike new inventory, which is often tied to seasonal trends, second hand branded shoes provide wholesalers with consistent opportunities to meet customer expectations at reduced sourcing costs.

The rising popularity of second hand branded shoes wholesale is driven by a few key market dynamics. First, global consumers are increasingly embracing sustainable fashion, and second hand branded footwear perfectly aligns with this trend. Second, many developing markets lack affordable access to premium shoes, creating strong demand for bulk imports of used branded shoes. Third, the wholesale supply chain has matured, with better logistics, grading systems, and buyer-supplier networks, allowing B2B buyers to scale their operations more effectively.

For wholesalers and resellers, second hand branded shoes wholesale is not simply about moving used footwear. It is about tapping into a profitable business model that connects supply and demand across different regions while balancing sourcing costs, logistics, and grading standards. By understanding the structure of this trade, buyers can better capture profit opportunities and reduce risks in the process.

II. The Difference Between Second Hand Branded Shoes and Regular Used Shoes

Not all second hand shoes are equal in terms of quality, market positioning, or profitability. A major distinction exists between branded second hand shoes and regular unbranded used shoes, and this distinction has direct implications for wholesale buyers.

Value Perception in the Market

Branded shoes, even in their second hand form, carry inherent value because of the brand recognition and original craftsmanship associated with them. When wholesalers offer branded second hand shoes in bulk, their buyers—whether retailers or regional distributors—can market these products as premium used footwear. By contrast, regular used shoes lack the same market appeal, often being treated as low-value products intended for budget-conscious customers.

Durability and Resale Cycles

Second hand branded shoes typically outperform unbranded footwear in terms of durability. This makes them more reliable in wholesale distribution, as buyers can trust that the products will last longer for end consumers. Wholesalers can build stronger client relationships by consistently supplying shoes that meet quality expectations. On the other hand, regular used shoes may show signs of wear more quickly, reducing repeat purchase potential and lowering overall resale margins.

Pricing Strategy and Profit Margins

From a wholesale perspective, branded shoes command higher resale prices even after being used. This gives distributors more flexibility in setting markups when selling to regional retailers. While unbranded second hand shoes may move faster in volume, the margin per unit is typically lower. A B2B buyer evaluating Second Hand Branded Shoes Wholesale should always consider this trade-off between volume-driven sales and margin-driven sales.

Market Positioning for B2B Buyers

For international buyers who import bulk second hand branded shoes, the product positioning is critical. They can enter mid-tier and premium resale markets, rather than competing solely on low-cost segments. This creates differentiation and reduces the likelihood of direct price wars with wholesalers dealing only in unbranded used shoes.

In essence, the difference between branded and regular second hand shoes is not merely about logos. It reflects a broader profit model, where perception, durability, and resale pricing combine to make second hand branded shoes wholesale a more lucrative path for B2B buyers. For B2B buyers who need both premium and budget-friendly footwear, sourcing through Mixed Shoes Wholesale Second Hand Brand Shoes channels ensures a more flexible product mix.

III. Cost Structure in Wholesale: Procurement, Logistics, Duties, and Hidden Expenses

A critical aspect of understanding profitability in Second Hand Branded Shoes Wholesale lies in analyzing the true cost structure. Many B2B buyers focus primarily on purchase price, yet wholesale profits depend on a wide range of expenses that go beyond procurement.

Procurement Costs

At the foundation of the cost structure is procurement. Wholesale buyers typically source branded second hand shoes through established suppliers, bulk auctions, or specialized second hand markets. While the upfront price of branded second hand shoes may be higher than unbranded alternatives, the potential resale margins often justify this investment. Procurement also involves evaluating the grade of the shoes, ensuring that the quality aligns with the target resale market.

Logistics and Freight

Once procurement is complete, logistics becomes the next major expense. For international buyers, this can involve container shipping, air freight, or cross-border trucking depending on the target market. Freight charges vary significantly by route and shipping method. Moreover, logistics management includes not only transport but also packaging, warehousing, and handling, all of which must be accounted for in cost planning.

Customs Duties and Tariffs

Importing branded second hand shoes often involves customs duties, tariffs, and clearance fees. Different countries have specific regulations regarding the import of second hand footwear. Some impose higher tariffs due to perceived risks, while others may have restrictions requiring specific certifications. For B2B buyers, navigating customs compliance efficiently is critical to preventing delays or additional costs that could erode margins.

Hidden Expenses and Overheads

Beyond procurement and shipping, wholesale buyers must account for hidden costs. These may include:

- Inspection and grading fees if the supplier offers sorting services.

- Currency exchange risks for buyers purchasing internationally.

- Storage and warehousing charges before redistribution to retailers.

- Loss factors, such as unsellable shoes due to damage or quality discrepancies.

Many first-time wholesalers underestimate these hidden expenses, which can significantly impact profitability. Experienced B2B buyers, however, factor these costs into their calculations and negotiate accordingly with suppliers and logistics partners.

By clearly mapping procurement, logistics, customs, and hidden overheads, wholesalers can establish a transparent cost structure that ensures pricing decisions support long-term profitability. Working with a reliable second hand brand shoes supplier allows wholesalers to negotiate better procurement terms and secure consistent quality across shipments.

IV. The Impact of Grades and Categories on Profit Margins

Not all second hand branded shoes generate equal profits. Profitability in wholesale is closely tied to the grading system and the category of shoes being distributed.

Grading Systems in Second Hand Shoes Wholesale

Second hand branded shoes are typically categorized into different grades, reflecting their condition and resale potential:

Premium Grade: Shoes in near-new condition with minimal signs of use. These command the highest resale margins but also require higher upfront investment.

Mid-Grade: Shoes with visible wear but still in good functional condition. They appeal to mid-tier resale markets where affordability and durability balance.

Economy Grade: Shoes with heavier wear, often resold in volume-driven markets. While unit prices are low, margins are thinner and resale cycles shorter.

For wholesalers, choosing the right grade mix is essential. Focusing exclusively on premium grade may limit volume, while relying too heavily on economy grade may reduce profitability. The most successful B2B buyers strike a balance that matches their target markets.

Profitability by Shoe Categories

In addition to grades, categories such as athletic shoes, casual footwear, formal shoes, or seasonal items each influence margins differently. For example:

- Athletic shoes often have higher resale demand, especially branded models, giving wholesalers stronger leverage in pricing.

- Casual shoes offer consistent turnover but may face more competition from unbranded second hand shoes.

- Formal shoes may yield premium margins in specific markets but move more slowly.

- Seasonal footwear requires precise timing in distribution to avoid holding costs.

Wholesalers who analyze category-level profitability can optimize purchasing strategies and improve turnover efficiency. Some wholesalers balance their inventory by combining Used Brand Shoes and Mixed Shoes, which helps meet diverse customer demands while stabilizing margins.

Strategic Mix for B2B Buyers

For B2B buyers entering the second hand branded shoes wholesale market, the key lies in aligning grade and category with customer expectations. Retailers in emerging markets may prefer economy or mid-grade shoes for affordability, while resellers targeting urban markets may demand premium grade athletic footwear. By diversifying sourcing across different grades and categories, wholesalers minimize risk while maximizing margin opportunities.

In conclusion, profit margins in Second Hand Branded Shoes Wholesale are not determined solely by purchase price. They depend on a strategic balance of grades and categories, chosen with careful attention to the target market. B2B buyers who master this balance can build sustainable and scalable wholesale operations.

V. Effective Strategies to Control Risks and Reduce Costs

In the wholesale business of second hand branded shoes, the profit margins are attractive, but they come with risks that can erode long-term gains. For B2B buyers, these risks are not just about fluctuating procurement costs—they involve hidden quality issues, regulatory barriers, unpredictable demand, and inefficient logistics. The foundation of risk management begins with supplier selection. In the second hand branded shoes wholesale trade, working with a trusted supplier ensures consistent product quality, transparent grading, and reliable fulfillment.

Building long-term partnerships gives wholesalers bargaining power on procurement terms and helps secure priority during high-demand periods. Buyers should request trial orders, conduct site inspections when possible, and verify supplier credentials before scaling up. To build a sustainable model, wholesalers must implement deliberate strategies to control risks while simultaneously reducing costs.

Implementing Quality Control Mechanisms

Wholesale buyers must never rely solely on supplier claims. Independent quality checks—either through third-party inspection services or in-house grading—protect against receiving substandard batches. B2B buyers can negotiate contracts that include clear return clauses or compensation terms if the quality falls below agreed standards. This minimizes losses from unsellable stock and maintains reputation in downstream resale markets.

Diversifying Sourcing Channels

Relying on a single supplier exposes wholesalers to unnecessary risks. If that supplier faces disruption, regulatory issues, or fluctuating supply, the buyer’s operations could be severely impacted. By diversifying sourcing channels, wholesalers gain flexibility in pricing, product mix, and volume. A diversified supply network also improves negotiation leverage, enabling buyers to secure better procurement deals.

Streamlining Logistics and Storage

Logistics is often one of the largest cost centers in Second Hand Branded Shoes Wholesale. B2B buyers can reduce costs by optimizing container loads, consolidating shipments, and partnering with logistics providers that specialize in footwear or textile-related goods. Furthermore, adopting flexible warehousing solutions—such as shared storage facilities—helps reduce fixed overheads, particularly in high-cost markets.

Managing Regulatory and Customs Risks

Import regulations on used footwear vary across countries. Some regions may impose restrictions due to hygiene concerns, while others demand certifications or fumigation. To control risks, wholesalers must stay informed about customs regulations in their target markets. Working with experienced customs brokers reduces clearance delays, prevents unexpected fees, and ensures smoother cross-border operations.

Digital Marketplaces for Currency-Hedge Efficiency

Many second hand branded shoes wholesale transactions occur across borders, often involving currencies such as USD, EUR, or local currencies in Africa, Asia, or Latin America. Fluctuations in exchange rates can erode margins. B2B buyers can mitigate this by negotiating contracts in stable currencies, using forward contracts, or maintaining multi-currency accounts to manage cash flow more effectively.

Modern B2B buyers increasingly use online platforms to source and distribute wholesale goods. Leveraging digital marketplaces allows buyers to compare suppliers, monitor market trends, and secure better procurement terms. Digital integration also reduces transaction errors and enhances traceability, lowering administrative risks.

By combining supplier reliability, quality control, logistics optimization, and financial hedging, wholesalers can significantly reduce operational risks while improving cost efficiency. This creates a stronger foundation for scaling in the competitive second hand branded shoes wholesale industry.

VI. Profit Differences and Opportunities Across Major Markets

The wholesale trade of second hand branded shoes is inherently global. B2B buyers often source from one region and sell in another, taking advantage of disparities in purchasing power, consumer demand, and regulatory environments. Understanding these differences across markets allows wholesalers to maximize profitability and identify growth opportunities.

Emerging Markets: High Demand and Volume Potential

In many emerging markets—particularly in Africa, South Asia, and parts of Latin America—the demand for second hand branded shoes is driven by affordability. Consumers in these regions aspire to own branded footwear but may not have access to new retail channels. For wholesalers, this creates strong bulk demand. Margins may be lower on a per-pair basis due to price sensitivity, but the sheer volume of sales makes these regions highly profitable.

Developed Markets: Niche and Sustainable Fashion Trends

In developed markets such as Europe, North America, and East Asia, second hand branded shoes wholesale takes on a different dimension. Here, the appeal lies in sustainability and the growing resale economy. B2B buyers in these markets often focus on premium or mid-grade shoes, targeting resale shops, online platforms, and boutique second hand retailers. The margins are higher, but competition and consumer expectations around quality are also greater.

Regional Regulatory Differences

The regulatory environment varies significantly across countries. Some African nations welcome imports of second hand shoes as they stimulate local trade, while others impose bans to protect domestic industries. In Asia, tariffs and import restrictions differ widely, requiring wholesalers to research carefully before entering. For B2B buyers, aligning distribution strategy with regulatory realities is essential to avoid unexpected barriers.

Profitable Niche Distribution

Even within the same market, profitability varies depending on distribution channels:

- Retail-focused wholesalers sell directly to shops and chains, often benefiting from consistent repeat orders.

- Market traders and bulk distributors thrive in high-volume, low-margin environments, especially in developing countries.

- E-commerce integrated wholesalers focus on supplying online resale platforms, where branded second hand shoes can command premium prices.

B2B buyers must select the right channel mix for each market. For example, premium-grade athletic shoes may sell profitably through e-commerce in Europe, while mid-grade casual shoes may achieve better turnover through physical markets in Africa. In Europe and North America, demand for The brand second hand men’s sneakers remains strong, especially among resale platforms focused on sustainable fashion.

Beyond mainstream markets, niche opportunities are emerging in areas such as children’s second hand branded shoes, vintage collections, and regional-specific footwear preferences. Wholesalers who understand these niches can differentiate themselves and capture higher margins with less competition.

Risk and Reward Across Borders

Ultimately, profit opportunities in second hand branded shoes wholesale are tied to balancing risk and reward across borders. Developed markets offer high margins but require strict quality and compliance standards. Emerging markets deliver volume-driven profitability but demand careful cost management. B2B buyers who diversify across both types of markets can stabilize cash flow and hedge against regional downturns.

By carefully mapping demand patterns, regulatory frameworks, and distribution strategies, wholesalers can identify where their sourcing and distribution networks will yield the strongest returns.

VII. Conclusion

The global trade of second hand branded shoes wholesale represents a profitable, sustainable, and scalable business opportunity for B2B buyers. Unlike regular used footwear, branded second hand shoes carry built-in market value, offering wholesalers higher margins, stronger resale potential, and wider geographic appeal.

The path to profitability, however, is not without challenges. Procurement costs, logistics expenses, customs duties, and hidden overheads all influence the bottom line. Additionally, the grading and categorization of shoes significantly determine resale value, requiring wholesalers to carefully select their sourcing strategies.

To succeed, B2B buyers must take a strategic approach:

- Build strong supplier partnerships and enforce quality controls.

- Optimize logistics and financial management to reduce costs.

- Diversify sourcing channels and distribution networks to minimize risks.

- Match product grades and categories with the right markets to maximize margins.

- Stay agile in responding to global regulatory differences and consumer trends.

The profitability of second hand branded shoes wholesale is not tied to short-term gains but to long-term operational discipline and market insight. Buyers who master these elements can expand into multiple regions, capture consistent returns, and establish themselves as trusted wholesale partners in the global footwear trade.

As consumer demand for sustainable and affordable fashion continues to grow, the role of second hand branded shoes in wholesale distribution will only become more significant. For B2B buyers, now is the time to align strategy, strengthen supply chains, and capitalize on the expanding opportunities in this high-potential sector.