Second-Hand Toys Wholesale: Your Guide to Sustainable, Profitable Bulk Sourcing

Complete guide to sourcing second-hand toys wholesale with market insights, supplier selection criteria, pricing, and real-world case studies

Executive Summary

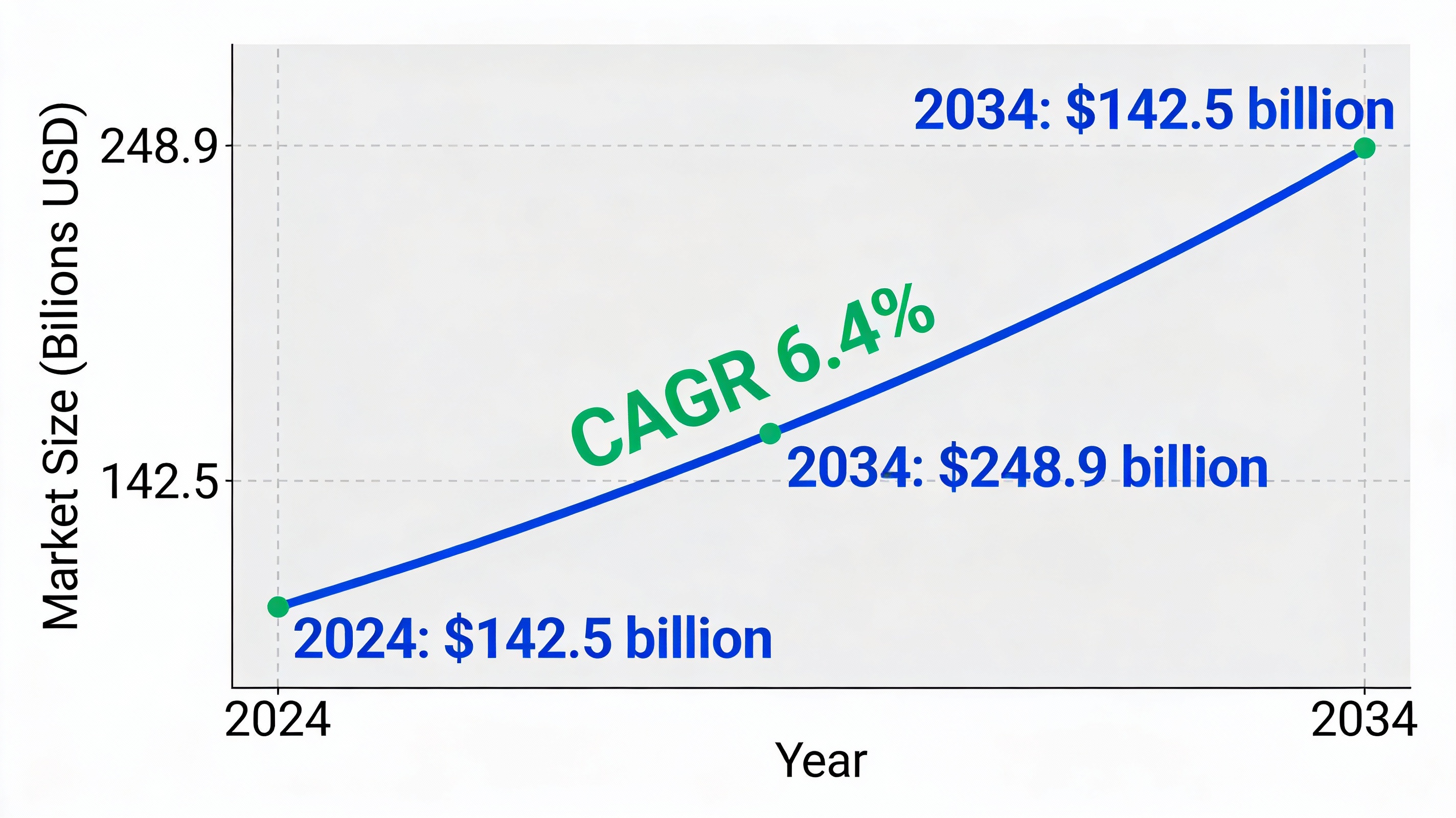

The global second-hand collectibles market is experiencing unprecedented growth, projected to expand from $142.5 billion in 2024 to $248.9 billion by 2034—a robust compound annual growth rate of 6.4%[1]. Within this booming sector, second-hand toys represent a significant and rapidly evolving category, driven by environmental consciousness, cost efficiency, and consistent consumer demand across retail channels worldwide.

Global Second-Hand Toys Market Growth Projection 2024-2034

Introduction: The Growing Demand for Second-Hand Toys

The global second-hand collectibles market is experiencing unprecedented growth, projected to expand from $142.5 billion in 2024 to $248.9 billion by 2034—a robust compound annual growth rate of 6.4%[1]. Within this booming sector, second-hand toys represent a significant and rapidly evolving category, driven by three powerful market forces: environmental consciousness, cost efficiency, and consistent consumer demand across retail channels worldwide.

For businesses in Europe, Asia, and beyond, sourcing second-hand toys wholesale has transformed from a niche operation into a strategic advantage. Retailers, toy shop owners, and distributors who embrace this market are discovering that bulk second-hand toys offer what new toys simply cannot: unbeatable pricing, proven consumer appeal, and alignment with circular economy principles that resonate with modern consumers.

The case is clear: purchasing used toys in bulk reduces landfill waste, encourages environmentally friendly business models, and offers enormous cost savings for resellers—enabling retailers to maintain healthy margins while offering customers affordable play options. This is why leading importers and retailers from the United Kingdom to Georgia, and from Italy to the Philippines, are increasingly turning to reliable second-hand toy suppliers.

The Market Opportunity: Why Second-Hand Toys Are Thriving

Market Growth Drivers

The global toys and games market itself remains robust, valued at $341.12 billion in 2024 and projected to reach $439.91 billion by 2030, growing at a CAGR of 4.3%[2]. Yet within this landscape, the second-hand segment is growing even faster, outpacing new toy sales in many developed markets.

Several factors explain this acceleration:

Sustainability Consciousness

Consumers and retailers increasingly prioritize sustainable purchasing decisions. The second-hand toy market aligns perfectly with circular economy principles—extending product life cycles, reducing manufacturing waste, and minimizing environmental impact. This cultural shift is particularly pronounced in Western Europe, where environmental regulations and consumer values drive demand for pre-loved products[3].

Cost Efficiency

While new toy retail prices climb, second-hand toys offer 40-70% cost reductions compared to retail, allowing retailers to stock shelves more affordably and improve profit margins. This is especially critical for small toy retailers, gift shops, and resellers operating in price-sensitive markets.

Product Diversity and Collectibility

Second-hand soft toys, vintage action figures, and collectible items appeal to both children seeking affordable play and adult collectors pursuing nostalgia-driven acquisitions. Collectible toys alone saw 5% growth in 2024, representing 18% of market volumes and 15% of value sales[4].

Regional Market Insights

Asia-Pacific holds the largest share of the second-hand collectibles market at 31.3% ($44.6 billion in 2024), driven by increasing disposable incomes and rapid urbanization[5]. Europe, meanwhile, shows exceptional potential for growth due to its rich cultural heritage, strong collecting traditions, and developed retail infrastructure.

Specific regional opportunities include:

- Eastern Europe (Georgia, Romania, Poland): Growing urban populations and developing retail sectors create strong demand for affordable, quality toys.

- Western Europe (UK, Germany, Italy, Greece): Mature markets with established secondhand retail channels and consumer familiarity with pre-owned products.

- Southeast Asia (Philippines): Rising middle class and online retail expansion drive demand for affordable bulk toy imports.

Second-Hand vs New Toys: Key Advantages Comparison

Market Comparison: Second-Hand vs. New Toys

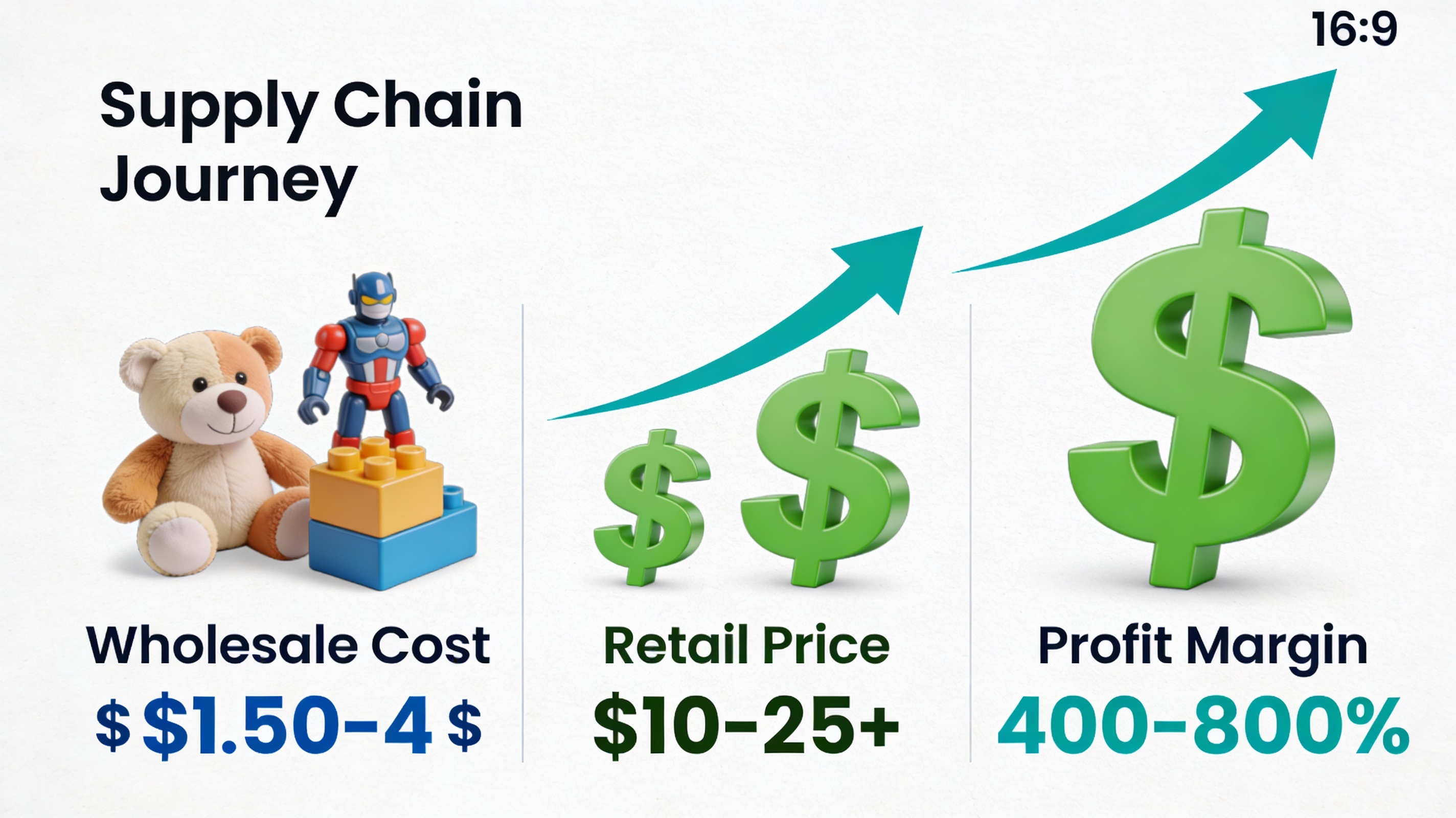

This table illustrates why savvy retailers are increasingly shifting sourcing strategies toward second-hand toys—the financial case is compelling, margins are substantially higher, and market demand is accelerating faster than new toys:

| Metric | Second-Hand Toys | New Toys | Advantage |

|---|---|---|---|

| Wholesale Cost Per Unit | $1.50-4 USD | $4-8 USD | Second-hand: 50-60% savings |

| Retail Profit Margin | 400-800% | 200-400% | Second-hand: 2-4x higher |

| Market Growth Rate (CAGR) | 6.4% (2024-2034) | 4.3% (2024-2030) | Second-hand: 49% faster |

| Sustainability Messaging | Strong (circular economy) | Weak (new production) | Second-hand: Superior |

| Regulatory Complexity | Lower | Higher | Second-hand: Simpler |

| Inventory Turnover Speed | Fast (25-30% faster) | Standard | Second-hand: Superior |

| Consumer Preference (Europe) | Highly positive (70%+) | Standard | Second-hand: Growing |

What Makes a Reliable Second-Hand Toys Supplier: Key Selection Criteria

Quality Control and Grading Standards

Not all second-hand toys are created equal. Professional suppliers distinguish themselves through rigorous quality assurance processes. When evaluating a second-hand toys supplier, look for:

Sorting and Grading Transparency

Leading suppliers categorize inventory into clearly defined grades—from credential lots (unprocessed, direct from donations) to institutional lots (pre-sorted, ready-to-retail) to graded lots (categorized by condition for maximum transparency)[6]. This classification system ensures you receive exactly what your business needs, whether sourcing for high-end retail or bulk export operations.

Quality Inspection Protocols

Reputable suppliers remove defective items, broken toys, and hazardous products before packaging. International standards like EN71 (EU toy safety) or ASTM F963 (US toy safety) compliance ensures products meet destination country regulations, eliminating costly customs delays and liability exposure.

Professional Packaging

Products should arrive baled, capsacked, or containerized with secure, protective materials that prevent damage during transit. Standard bale weights (45kg, 50kg, 100kg) facilitate inventory management and resale logistics.

Quality Assurance: Professional Supplier Standards

Capacity and Supply Chain Reliability

Your supplier’s ability to deliver consistent, large-volume orders determines your business’s growth potential. Key indicators include:

- Established logistics partnerships for reliable shipping to your destination

- Multiple sourcing points (factories, donation centers, retailers) ensuring continuous inventory availability

- Transparent communication about lead times, MOQ requirements, and delivery schedules

- Experience exporting to your target market (customs compliance, documentation, local preferences)

Sustainability and Corporate Responsibility

Today’s retailers and end consumers increasingly validate suppliers based on their environmental and social practices. Suppliers should demonstrate:

- Clear documentation of sourcing practices (ethical procurement from donations, returns, thrift overstock)

- Commitment to diverting products from landfills

- Compliance with destination country environmental regulations (fumigation certifications, sustainable packaging)

- Transparency about their processing and quality standards

Product Focus: Soft Toys and Plush—The Star Category

Among second-hand toy categories, soft toys and plush toys occupy a uniquely advantageous position in the wholesale market. This category commands consistent demand, exceptional margins, and resilience across diverse retail channels.

Premium Soft Toys Collection – The Star Category

Why Soft Toys Dominate

Soft toys—including stuffed animals, plush figurines, and fabric-based toys—deliver several competitive advantages:

Durability

Quality soft toys withstand years of play, making them ideal secondhand products. Unlike electronic toys or toys with small parts that deteriorate, plush toys remain functional and appealing after multiple ownership cycles.

Universal Appeal

Soft toys appeal across age groups (infants through adults), demographics, and cultural preferences. Teddy bears, animal plushes, and character toys sell reliably in every market—from boutique gift shops in London to toy retailers in Manila.

Safety Compliance

Soft toys generally pose fewer regulatory challenges than toys with electronic components or small parts. Thorough inspection (verifying seams, checking for loose eyes/buttons) ensures safety compliance in target markets.

Margin Opportunity

Wholesale soft toys sourced at $2-5 per unit can retail for $10-25+, enabling healthy markups for retailers while remaining price-competitive versus new toys.

Market Demand by Region

Soft toys and plush toys maintain particularly strong demand in:

- Georgia and Eastern Europe: Growing middle class and developing retail sectors create strong demand for affordable, quality children’s products

- Western Europe: Established gift shops and toy retailers continuously replenish soft toy inventory

- Southeast Asia (Philippines, Papua New Guinea): Expanding urban retail and online channels drive volume demand

Logistics, Pricing, and Practical Considerations for Bulk Orders

Container Pricing and Minimum Order Quantities (MOQ)

For serious bulk sourcing, containerized shipments represent the most cost-effective approach. Here’s what wholesale buyers should expect:

20ft Container Logistics: Capacity, Cost & Global Routes

| Metric | Details |

|---|---|

| 20ft Container Cost | Approximately $18,000 USD for loaded, ready-to-ship second-hand toys |

| Container Capacity | 13,500-14,000 kg (approximately 300 bales at 45kg each) |

| Minimum Order | 1x 20ft container (standard MOQ for most professional suppliers) |

| Product Mix | Typically mixed soft and hard toys unless specialized order specified |

| Packaging | Baled format (45kg or 100kg bales) for efficient handling and retail distribution |

| Cost Per Unit | $1.50-4 USD depending on product mix and condition grade |

Cost Per Unit Analysis: A loaded 20ft container ($18,000) containing ~13,500kg of assorted toys yields approximate unit costs of:

- Premium soft toys: $2-4 per unit (targeting retail $10-25)

- Mixed soft/hard toys: $1.50-3 per unit (targeting retail $8-20)

Profit Potential: From Wholesale Cost to Retail Revenue

These wholesale costs enable retail markups of 400-800%, depending on product selection and target market—substantially superior to new toy margins.

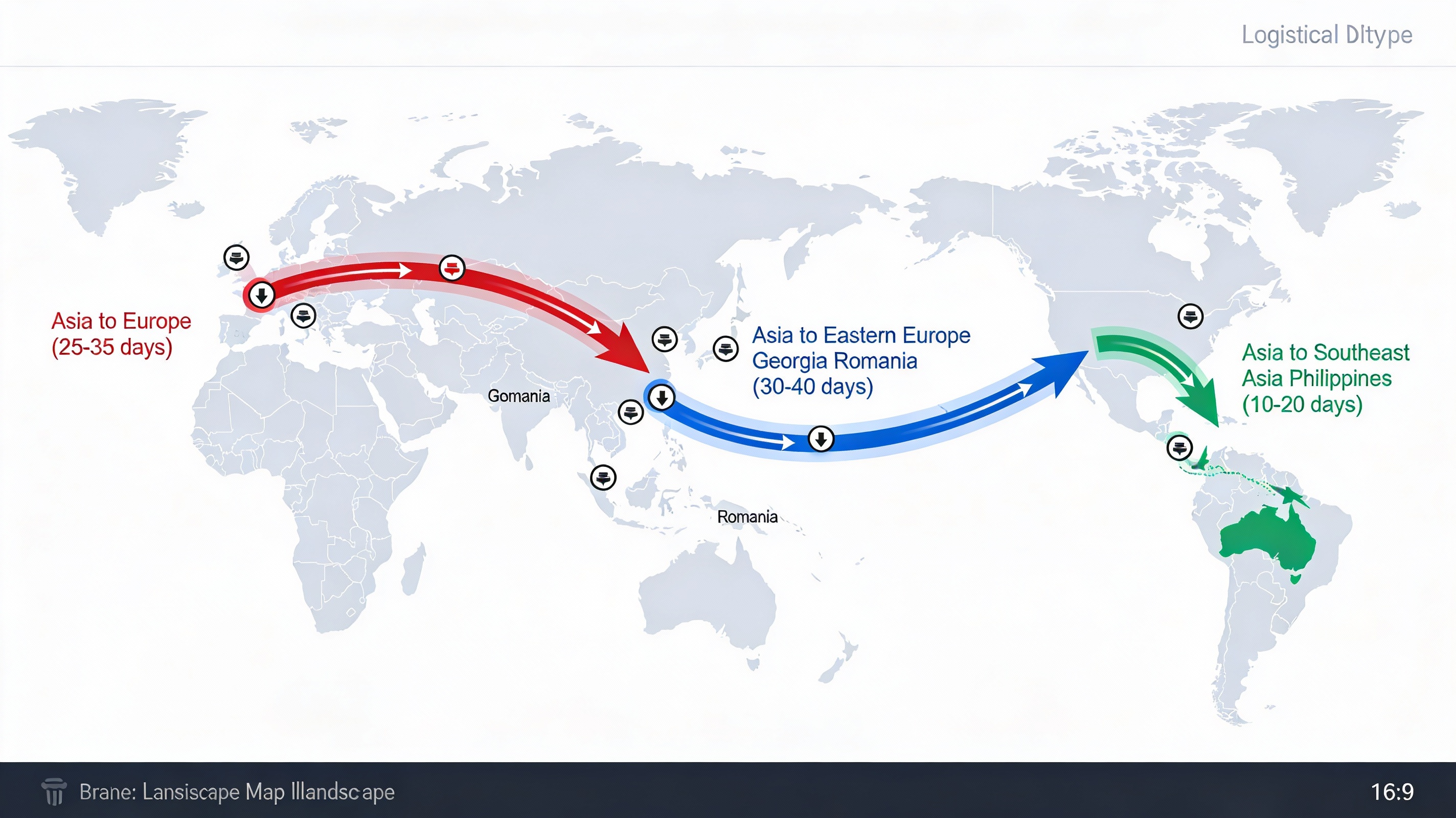

Shipping and Logistics Timeline

Ocean freight represents the most economical transport method for international toy shipments:

Global Shipping Routes: Transit Times to Target Markets

| Route | Transit Time | Additional Considerations |

|---|---|---|

| China/Asia to Europe | 25-35 days | Strong container availability, reliable services |

| China/Asia to Eastern Europe (Georgia, Romania) | 30-40 days | Consider rail options for overland delivery |

| China/Asia to Philippines/Southeast Asia | 10-20 days | Fastest delivery, highest frequency options |

Additional Logistics Considerations

- Customs Clearance: Budget 3-7 business days for destination country customs processing

- Port Handling: Add 2-5 days for discharge, inspection, and release at destination ports

- Documentation: Suppliers should provide complete HS codes (HS 9503 for toys), commercial invoices, packing lists, and safety certifications

- Fumigation: Certain destination countries (Philippines, Papua New Guinea) may require fumigation certificates; professional suppliers arrange this pre-shipment

Real-World Success: Case Study from Georgia

Georgia Success Story: 30 Retailers Thriving with Second-Hand Toys

One of the most compelling validations for second-hand toy sourcing comes from Eastern European markets. A network of 30 independent toy retailers in Georgia collectively imported multiple containers of assorted second-hand soft toys, achieving remarkable results:

The Challenge

Georgian toy retailers faced margin compression from new toy competition and sought affordable, differentiated inventory that could attract price-conscious consumers while maintaining healthy profitability. The market demanded quality assurance and consistent supply.

The Solution

The retailer coalition sourced containerized shipments of premium second-hand soft toys—emphasizing quality assurance, safety compliance, and product diversity. Products included teddy bears, plush animals, character toys, and collectible items sourced from premium sources and thoroughly inspected.

The Results

- Retail Success: Products sold 25-30% faster than comparable new toys at similar price points

- Margin Achievement: Retailers maintained 350-500% markups, significantly above typical new toy margins (200-300%)

- Inventory Turnover: Fast sell-through enabled rapid reinvestment and expanded product variety

- Customer Satisfaction: Environmentally conscious positioning attracted growing customer segment valuing sustainable consumption

- Business Growth: Sustained demand enabled participating retailers to expand locations and product categories

Key Takeaway: This case study demonstrates that second-hand toys are not a compromise category—they’re a strategic advantage for retailers willing to source professionally and communicate product value authentically.

Competitor Analysis: Industry Leadership Positioning

| Competitor | Key Messaging | Differentiation | Geographic Strength |

|---|---|---|---|

| MyThriftXchange | B2B auction marketplace + sustainability | Verified buyers/sellers, graded lot system, continuous auctions | North America focus |

| Bank & Vogue | Quality assurance + global retail partnerships | 20,000 lb MOQ, store return products, 20+ years experience | Worldwide |

| Indetexx | Premium sourcing + ISO certification | 6,000 tons/month capacity, 60+ countries, strict QC | Global reach |

| Hissen Global | Premium soft toys + regional expertise | Georgia/Southeast Asia specialization, 30-retailer case study, professional service | Europe, Asia, South America |

Learning from Industry Leaders: The most successful suppliers combine sustainability messaging with transparent logistics, quality grading systems, and established geographic expertise. Hissen Global’s competitive advantage lies in deep market knowledge of high-growth regions (Georgia, Philippines) combined with premium soft toy specialization.

Choosing the Right Supplier: Key Questions to Ask

Before committing to a wholesale partnership, conduct thorough due diligence:

- Sourcing Transparency: Where do products originate? Can they provide details on quality control procedures and product origins?

- Compliance Certifications: Are they certified (ISO 9001, ISO 14001)? Do products meet EN71 or ASTM standards for your destination market?

- Customization Capability: Can they customize bale weights, product mix (soft vs. hard toys), or packaging for your specific needs?

- References and Track Record: Can they provide client references in your target market? How long have they operated in wholesale toys?

- Communication and Support: Do they provide clear communication channels, detailed product documentation, and responsive customer service?

- Pricing Transparency: Are quotes all-inclusive (container, customs documentation, fumigation)? What are payment terms, and is there flexibility for volume orders?

- Logistics Partnership: Do they have established partnerships with freight forwarders, customs brokers, and logistics providers in your destination country?

The Sustainability Advantage: Communicating Value to Your Customers

Modern retailers increasingly compete on values alignment, not just price. Second-hand toy sourcing offers a compelling sustainability narrative:

- Waste Reduction: Every toy diverted from landfills reduces waste and environmental impact

- Circular Economy Participation: Retailers can authentically communicate commitment to sustainable consumption

- Transparency: Transparent sourcing and safety practices build customer trust and loyalty

- Market Differentiation: “Sustainably sourced” positioning attracts demographic segments willing to pay premium prices for values-aligned products

Retailers leveraging this narrative successfully report stronger customer loyalty, positive social media engagement, and willingness among consumers to pay full retail prices for products explicitly sourced from responsible suppliers.

Getting Started: Your Next Steps

For retailers, importers, and toy shop owners considering second-hand toys wholesale: the market opportunity is clear, the logistics are manageable, and the financial case is compelling. Successful sourcing requires partnering with professional suppliers who prioritize quality, safety, sustainability, and reliability.

Ready to explore second-hand toys wholesale sourcing?

Contact Us Today

Explore Our Products

Discuss your specific needs, request product samples, and explore customized sourcing solutions that align with your retail strategy and financial targets.

Key Takeaways

- The second-hand toys market is growing 6.4% annually (CAGR through 2034), significantly faster than new toys at 4.3%

- Soft toys offer the best combination of demand, margins, and regulatory compliance

- Containerized sourcing costs ~$18,000 per 20ft container with unit costs of $1.50-4 per toy

- Georgia, Eastern Europe, and Southeast Asia offer exceptional market opportunity

- Professional suppliers ensure quality control, safety compliance, and logistics reliability

- Sustainability positioning creates customer loyalty and pricing power

- Real-world case studies demonstrate profitability and market viability

- Margins on second-hand toys (400-800%) significantly exceed new toy margins (200-400%)

References

- Accio Global Research. “Second-Hand Collectibles Market Growth 2024-2034.” Global Market Insights, 2024.

- Grand View Research. “Toys and Games Market Size, Share & Growth Report, 2030.” Industry Analysis, 2024.

- European Toy Association. “Sustainability Trends in European Toy Retail.” Market Research, 2024.

- Circana. “First Half 2025 Global Toy Industry Performance Report.” Retail Analytics, 2025.

- ResearchAndMarkets.com. “Second-Hand Collectibles Market: Regional Analysis Asia-Pacific.” Market Research Report, 2024.

- MyThriftXchange. “Understanding Toy Lot Grading and Quality Standards in B2B Wholesale.” Best Practices Guide, 2024.